Understanding AI Budget Generators

Definition and purpose of budget generators

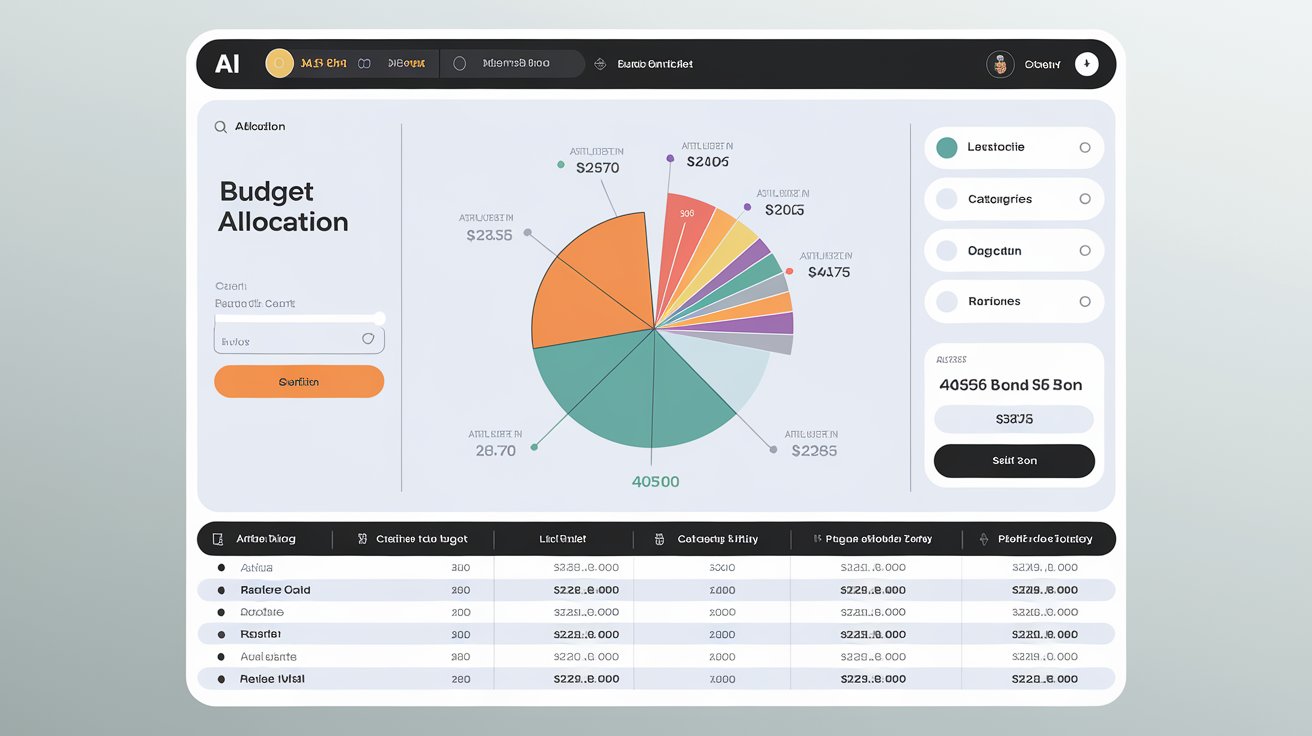

An AI budget generator is a tool that leverages artificial intelligence to help you create an efficient budget tailored to your unique financial situation. These tools simplify and streamline the budgeting process by automating budget creation based on the data you provide. Their main purpose is to enhance your financial planning capabilities by making it easier to track income, manage expenses, and set savings goals.

Also Read: Tracking Farm Expenses: Best Tools & Tips Budgeting

Key benefits of using AI in budgeting

Using an AI financial planning tool offers several benefits:

- Efficiency: Automated budget creation saves you time, allowing you to focus on other financial responsibilities.

- Accuracy: AI algorithms reduce the likelihood of human errors in calculations, providing you with more accurate budgeting outcomes.

- Personalization: You can generate personalized budgets using AI that take into account your financial goals, spending habits, and income levels.

- Insightful analytics: Many AI budgeting tools come with reporting features that help you understand your financial health better.

Overview of popular AI budget tools

Several tools can assist you in your budgeting journey. Popular options include GravityWrite’s Budget Planner, Involve.me’s Budget Plan AI Generator, and Taskade’s AI Budget Proposal Generator. These tools not only allow you to create a budget but also offer features that enhance your overall financial planning experience.

Steps to Create a Personalized Budget

Inputting your income details

The first step in the automated budget creation process is inputting your income details. Enter your monthly income sources, including salaries, side hustles, and any additional earnings. This step lays the foundation of your budget and helps you understand how much money you have at your disposal.

Listing and categorizing expenses

Once you have detailed your income, the next step is to list and categorize your expenses. Break down your monthly expenses into fixed and variable categories. Fixed expenses typically include rent or mortgage payments, utility bills, and loan repayments. Variable expenses may consist of groceries, dining out, entertainment, and discretionary spending. This categorization will enable you to see where your money is going and identify areas where you can cut back.

Setting financial goals and savings targets

After listing your expenses, it’s time to set financial goals and savings targets. Consider your short-term and long-term objectives, whether it’s saving for a vacation, building an emergency fund, or planning for retirement. By outlining these goals within your budget, you can direct your spending and savings strategies effectively.

Features of Effective Budget Generators

Customization options for users

The best AI tools to generate monthly budgets offer extensive customization options. Whether you need to adjust categories for specific expenses or set personalized savings goals, effective budget generators allow you to fine-tune your budget according to your needs. Customization enables you to interact more meaningfully with your financial data.

Integration with other financial tools

Effective AI financial planning tools often integrate with various financial platforms, enabling you to track all your accounts in one place. This integration helps you monitor your expenses in real-time, making it easier to stay aligned with your budget and adjust as necessary.

Analytics and reporting capabilities

In addition to budgeting, effective AI budget generators provide analytics and reporting features that offer insights into your spending habits. These features can highlight trends over time, allowing you to see where you can improve financially. Using analytics can significantly enhance your smart budgeting with AI.

Best Practices for Budget Management

Regular reviews and adjustments

To maintain an effective budget, regular reviews and adjustments are crucial. At least once a month, go through your budget to see if you are on track with your spending and saving goals. Make adjustments based on any changes in your income or expenses to ensure that your budget reflects your current financial situation.

Utilizing AI for ongoing financial analysis

AI tools are not just for initial budget creation; they can assist you in ongoing financial analysis. By using the insights provided by your AI financial planning tool, you can continually refine your budget to suit your lifestyle. Whether it is recognizing spending patterns or identifying potential savings opportunities, ongoing financial analysis is an invaluable feature.

Staying informed about personal finance trends

Staying informed about personal finance trends can help you make better budgeting choices. Follow reputable financial news sources, blogs, and websites that provide up-to-date information on economic conditions and financial planning strategies. This knowledge will empower you to make informed decisions about adapting your budget based on broader financial trends.

FAQs

What is an AI budget generator?

An AI budget generator is a software tool that utilizes artificial intelligence to automate the creation of personal or business budgets, allowing users to plan their finances more efficiently.

How does AI improve budget planning?

AI improves budget planning by providing automated calculations, reducing human error, offering personalized budget recommendations, and providing insightful analytics that guide users towards achieving their financial goals.

What features do top AI budget tools offer?

The best AI budgeting tools typically offer customization options, integration with other financial platforms, analytics and reporting capabilities, and user-friendly interfaces that make budget tracking simpler.

Can small businesses benefit from AI budgeting?

Absolutely! Small businesses can significantly benefit from AI budgeting by gaining insights into spending patterns, improving financial planning, and streamlining the budgeting process.

Can I use AI to create a budget?

Yes, you can use various AI budget generators available online to create a personalized budget that aligns with your financial goals.

Can ChatGPT do my budget?

While ChatGPT can assist you in creating a budget by guiding you through the process and generating recommendations, it is advisable to double-check its suggestions and calculations against reliable resources.

What is the best budgeting AI?

The best budgeting AI tools are subjective and depend on your specific needs, but popular options include GravityWrite, Involve.me, and Taskade.

Is there a completely free AI generator?

Many AI budgeting tools offer free versions or trials, but be sure to check the features included, as some advanced features may require a subscription.

What’s the AI generator everyone is using?

Though various AI budget generators are popular, each user’s choice often depends on personal preferences and specific budgeting needs. Common tools include GravityWrite and Involve.me, which have garnered attention for their user-friendly interfaces and effective budgeting capabilities.