Understanding Expense Tracking Notebooks

Benefits of Using a Physical Notebook

Using an expense tracker notebook provides several advantages over its digital counterparts.

Firstly, writing down expenses by hand often helps you retain the information better, promoting mindfulness regarding your spending habits. When you manually log each purchase, you may think twice before making unnecessary expenditures, leading to a more deliberate approach to finance.

Read More: How to Use a 1099 Expense Tracker to Simplify Your Finances

Moreover, a physical daily expense tracker notebook is always accessible, requiring no battery life and functioning without internet connectivity. This simplicity allows you to jot down expenses anytime, anywhere, without the distractions of notifications or app alerts.

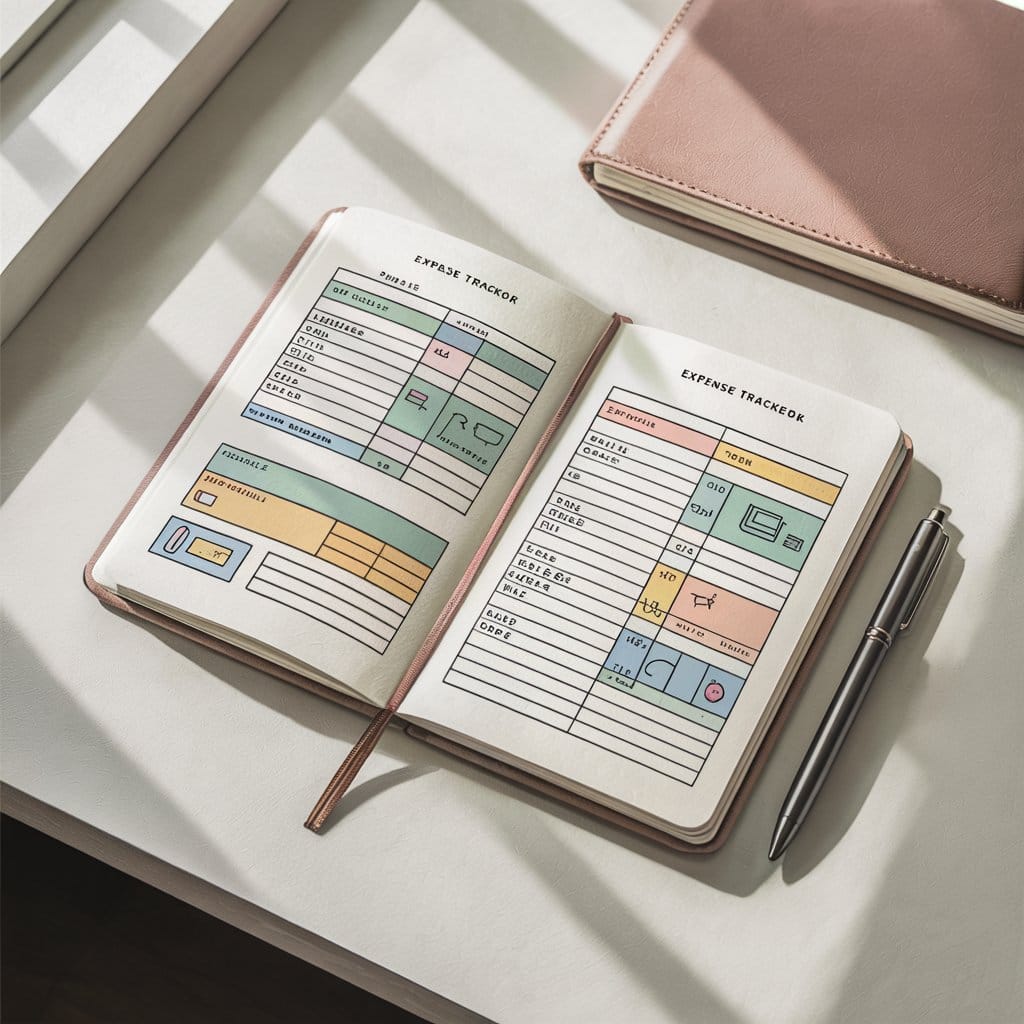

Key Features to Look For in Trackers

When choosing an expense tracker notebook, look for specific features that can enhance your tracking experience. Key components may include:

Structured Layouts: Ensure the notebook offers dedicated spaces for different categories such as groceries, rent, utilities, and entertainment. A clever fox budget planner expense tracker notebook typically includes these features, making organization simple.

- Bill Tracker Pages: Having dedicated pages for tracking bills can prevent overdue payments and simplify budgeting.

- Income Tracking Sections: An effective income and expense tracker should allow you to record not just what you spend but also what you earn.

- Monthly Overview: Monthly budgeting journals often provide summary pages that give an overview of your finances at a glance, aiding in future planning.

Comparison with Digital Tracking Methods

While digital methods like apps and spreadsheets can be effective, they come with downsides. Digital trackers require a device and consistent internet access, which can be problematic in some situations.

Additionally, some users may find themselves overwhelmed by complex interfaces or distracted by other apps.

Conversely, a physical bookkeeping notebook encourages a focused approach to finance. The act of writing can be therapeutic, providing a moment of reflection about your financial status and goals.

Choosing the Right Tracker

Popular Brands and Their Offerings

Numerous brands create high-quality expense trackers, each with unique offerings. The Clever Fox Budget Planner is particularly noted for its comprehensive layout and user-centric design. Other options include The Paper Junkie Expense Tracker and various traveler’s notebook inserts specifically designed for expense tracking.

Paper Quality and Layout Options

The quality of materials used in an expense tracker can significantly affect your experience. Look for notebooks made from durable, thick paper that can withstand frequent use. Also, consider the layout; some users prefer a free-form style to allow for creativity, while others prefer structured templates for consistency.

Size and Portability Considerations

The size of your expense tracker notebook should align with your lifestyle. If you frequently travel or commute, a smaller, portable option may suit you best.

However, if you enjoy having ample space to write, a larger notebook may be more appropriate.

Setting Up Your Expense Tracker

Categories for Effective Tracking

Begin by establishing categories that make sense for your financial landscape. General categories could include housing costs, food, transportation, entertainment, and savings. A well-organized daily expense tracker notebook should provide plenty of room to differentiate between these categories.

Establishing Monthly Goals

Crafting monthly budget goals is another essential step in maximizing your savings. Determine how much you plan to spend in each category and work toward holding yourself accountable. Using a monthly budgeting journal helps you visualize these goals clearly.

Recording Daily Expenses Efficiently

To keep your expense tracking routine seamless, record your expenses daily or weekly. Set aside a specific time each day, perhaps in the evening, to review your spending. This practice not only promotes habit but also allows you to reflect on and understand your spending patterns over time.

Tips for Consistent Use

Creating a Routine for Tracking

Regularly incorporating your expense tracking into your daily routine is crucial. Whether it’s a morning or evening ritual, find a consistent time that suits you, making this practice one of your priorities.

Reviewing and Adjusting Your Budget

Take the time to review your budget periodically. Analyze your spending against your goals and adjust as necessary. This reflection is vital to ensuring that you stay on track and make informed financial decisions.

Staying Motivated with Rewards for Savings

Implement a rewards system for yourself each time you hit a saving milestone or stay under budget. This could be something small like treating yourself to a favorite coffee or a bigger non-financial goal, such as a day trip. These motivations can help maintain the consistency and discipline in tracking your expenses.

Analyzing Your Spending Habits

Identifying Trends and Patterns

As you record expenses over time, begin analyzing them for trends. Are there recurring charges that might indicate a need for adjustment? Identifying patterns in your spending can highlight areas for improvement, such as excessive dining out or impulse purchases.

Adjusting Budget Based on Insights

Use insights gained from analyzing your spending to make adjustments to your budget. Perhaps you find that your entertainment budget needs to be reduced and redirected towards savings. Make these necessary changes to better align with your long-term financial goals.

Setting Long-Term Financial Goals

Having long-term financial goals provides a destination for your budgeting efforts. Whether you’re saving for a home, a vacation, or retirement, understanding your ultimate financial objectives can guide your spending habits and encourage adherence to your budget.

Integrating Expense Tracking with Budgeting

Differences Between Budgeting and Tracking

While budgeting and expense tracking may seem similar, they serve distinct purposes. Budgeting involves creating estimates for future spending, while expense tracking involves documenting your actual expenditures. Using both methods effectively can provide a comprehensive view of your financial situation.

How Trackers Can Support Budget Planning

An expense tracker notebook is an invaluable tool to complement your overall budgeting strategy. By clearly documenting where you allocate your funds, you can adjust your budgets and allocate resources to meet your financial needs more effectively.

Real-Life Examples of Successful Implementations

Countless individuals have successfully implemented expense tracking into their budgeting.

For example, a family may utilize a clever fox budget planner expense tracker notebook to monitor their spending on groceries. By observing where they overspend, they can adjust their budget and identify areas to reduce costs, ultimately leading to increased savings.

FAQs

What is an expense tracker notebook?

An expense tracker notebook is a physical or digital tool used to record and monitor your spending habits over time.

How to use the expense tracker notebook?

You can use your expense tracker notebook by logging every purchase you make. Categorize expenses, review them regularly, and adjust your budget accordingly.

Benefits of using an expense tracker notebook?

The benefits include increased financial awareness, improved budgeting accuracy, and the ability to identify spending patterns effectively.

What features are included in the latest update?

Updates typically include enhanced layouts for easier categorization, additional tracking sections like bill payments, and goal-setting pages.

What is the best expense tracker?

The best expense tracker varies based on individual preferences; however, options like the clever fox budget planner expense tracker notebook are popular among users for their structured designs.

What are the sheets to track expenses?

Expense tracking sheets generally include sections for entering dates, amounts spent, categories, and notes.

How do I track my own expenses?

To track your expenses effectively, consistently record your purchases in your expense tracker notebook, categorize them, and review your budget regularly.

Is Excel good for tracking expenses?

Excel can be an effective tool for tracking expenses if you prefer a digital format.

However, it may not provide the same engagement as a physical tracker.

Can I use Excel for bookkeeping?

Yes, Excel can be used for bookkeeping, but dedicated bookkeeping software or a physical bookkeeping notebook might streamline the process and minimize errors.

Expense Tracker Notebook 2025

Budgeting Notebook

As you consider budgeting for the upcoming year, investing in a dedicated budgeting notebook can streamline your financial planning processes. These notebooks often include sections for tracking monthly and yearly expenses.

Income Expense Ledger

An income expense ledger is crucial for maintaining financial stability. It ensures you track both what you earn and what you spend effectively, helping you identify any discrepancies.

Expense Notebook

An expense notebook, whether a daily expense tracker notebook or a specialized bill tracker notebook, will keep your financial situation organized. The more organized your financial records, the easier it becomes to manage your finances effectively.

Conclusion

Incorporating an expense notebook into your financial routine can significantly impact your savings potential. The benefits of using such trackers whether a daily expense tracker notebook or a clever fox budget planner expense tracker notebook extend beyond mere record-keeping. They empower you to make informed financial decisions, analyze your spending habits, and ultimately achieve your savings goals. Whether you’re documenting monthly budgets or daily bills, having a firm grasp of your financial landscape is key to maximizing savings and achieving long-term financial success.