Materials Needed for Your Layout

Suggested Tools and Supplies

To create an effective expense tracker bullet journal, you will need a few essential tools and supplies. Start with a quality bullet journal. This can be anything from a simple notebook to a more sophisticated dotted journal that offers a flexible structure for your layouts. You will also need pens in various colors, preferably both fine-tipped and brush pens, along with highlighters or mildliners to give your pages a colorful pop. Ruler and stencils can be useful for creating clean lines and borders.

Also Read: How to Create an Effective Bullet Journal Expense Tracker

Selecting a Suitable Journal

When selecting your bullet journal, consider the size and durability. A medium-sized journal (around 5×7 inches) can be convenient for portability, while a larger size (8×10 inches) offers more space for elaborate layouts. Look for a journal with good quality paper to prevent bleed-through and ensure your entries remain neat and organized over time.

Importance of Color and Design

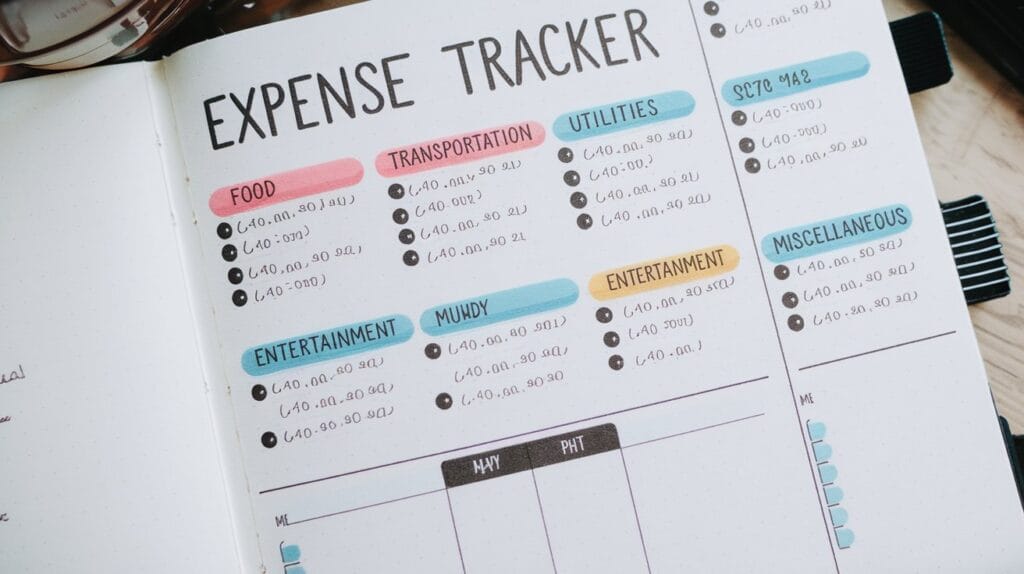

Incorporating color and design into your expense tracker can enhance your motivation to track your budget consistently. Use color coding to represent different categories of expenses, making it easier to visualize where your money goes. Decorative elements, including doodles and themed art, can turn your tracker into a visually appealing spread, encouraging you to engage with your financial planning actively.

Designing Your Tracker Spread

Planning the Page Layout

Before diving into the lettering and illustrations, sketch a basic layout for your tracker spread on a separate sheet. A common layout includes sections for monthly income, a dedicated budget for each category, and a column for expenses. By having the categories pre-defined, you will know exactly what you need to track and how much you are allocating for each. This simple organization lays a strong foundation for managing your finances efficiently.

Including Cash Flow Budgets

Integrating cash flow budgets into your expense tracker bullet journal is crucial. Assign your income to fixed bills, variable expenses, and savings. The cash flow budget shows the expected cash coming in and going out, helping you to manage your monthly finances better. This approach allows you to ensure that every dollar you earn has a purpose, creating a more structured path towards your financial goals.

Utilizing Visual Elements like Charts

Visual elements like charts and graphs can help illustrate your financial journey over time. Create pie charts indicating the breakdown of your expenses or bar graphs to depict your savings progress. Visual representations of your financial data can make it easier to identify patterns in your spending habits and are often more engaging than just numbers on a page.

Tracking Expenses Efficiently

Setting Up Columns for Clarity

When tracking expenses, clarity is key. Set up clear columns that allow you to log the date, the description of the expense, the amount spent, and the category it falls under. This organized format simplifies reviewing your spending at the end of each month and can help you identify areas where adjustments can be made.

Maintaining Monthly Logs

Your monthly expense tracker should include dedicated pages for each month. At the beginning of each month, set aside time to fill in expected expenses and income based on the previous month’s data. This log serves not only as a tracking tool but also as an early warning system when approaching budget limits.

Analyzing Spending Patterns Regularly

Regularly analyze your spending patterns by reviewing your expense tracker. Look for trends such as overspending in particular categories, frequent impulse purchases, or ongoing fixed expenses that might be re-evaluated. Understanding these patterns allows for informed decisions and adjustments to your budget and tracking strategies.

Establishing Financial Goals

Defining Specific Savings Goals

To ensure your expense tracker bullet journal is effective, set specific financial goals. Whether you’re saving for a vacation, a new gadget, or paying off debt, clarity about what you want to achieve can help you stay focused. Create a separate section in your journal dedicated to these goals, and regularly track your progress towards them.

Incorporating Wish Lists for Motivation

Additionally, maintain a wish list to accompany your savings goals. Include items you wish to purchase or experiences you want to have, providing a motivational aspect to your tracking. Every time you save a certain amount or cut down on impulsive spending, check off an item on your wish list, linking your everyday financial decisions to these overall objectives.

Evaluating Progress and Adjustments

At the end of every month, take the time to evaluate your progress towards your financial goals. Reflect on which methods worked and what didn’t. Allow yourself to adjust your budgeting categories and spending habits as necessary. This flexibility is crucial for sustaining motivation and achieving your financial aspirations over time.

FAQs

What is a bullet journal expense tracker?

A bullet journal expense tracker is a visual method for managing your personal finances. It involves using a dedicated spread in a bullet journal to record and categorize your expenses, helping you stay accountable and aware of your spending habits.

How do I set up budget spreads?

To set up budget spreads, create a layout that includes sections for your monthly income, fixed expenses, and variable expenses. Establish categories that make sense for your lifestyle, and use this layout to keep track of what you anticipate spending throughout the month.

What are layout ideas for tracking expenses?

Consider creating a grid structure for logging expenses, where each row represents an individual purchase, and each column includes relevant details like the date, description, category, and cost. Additionally, incorporate graphs and charts to visualize your spending patterns, aiding in quicker adjustments.

How can I manage monthly finances effectively?

Managing monthly finances effectively involves establishing consistent tracking methods, setting clear budgeting categories, analyzing your spending patterns, and defining financial goals within your bullet journal. Regular review sessions can help maintain this financial discipline while allowing for necessary adjustments.

By committing to using an expense tracker bullet journal, you will cultivate better money management habits, leading to greater financial security and satisfaction.